What Is Wage Advance?

Wage advance, or earned wage access, is a new and growing employee benefit category. It allows employees to access wages they’ve already worked for but that haven’t been paid out yet — without the employer needing to front the capital.

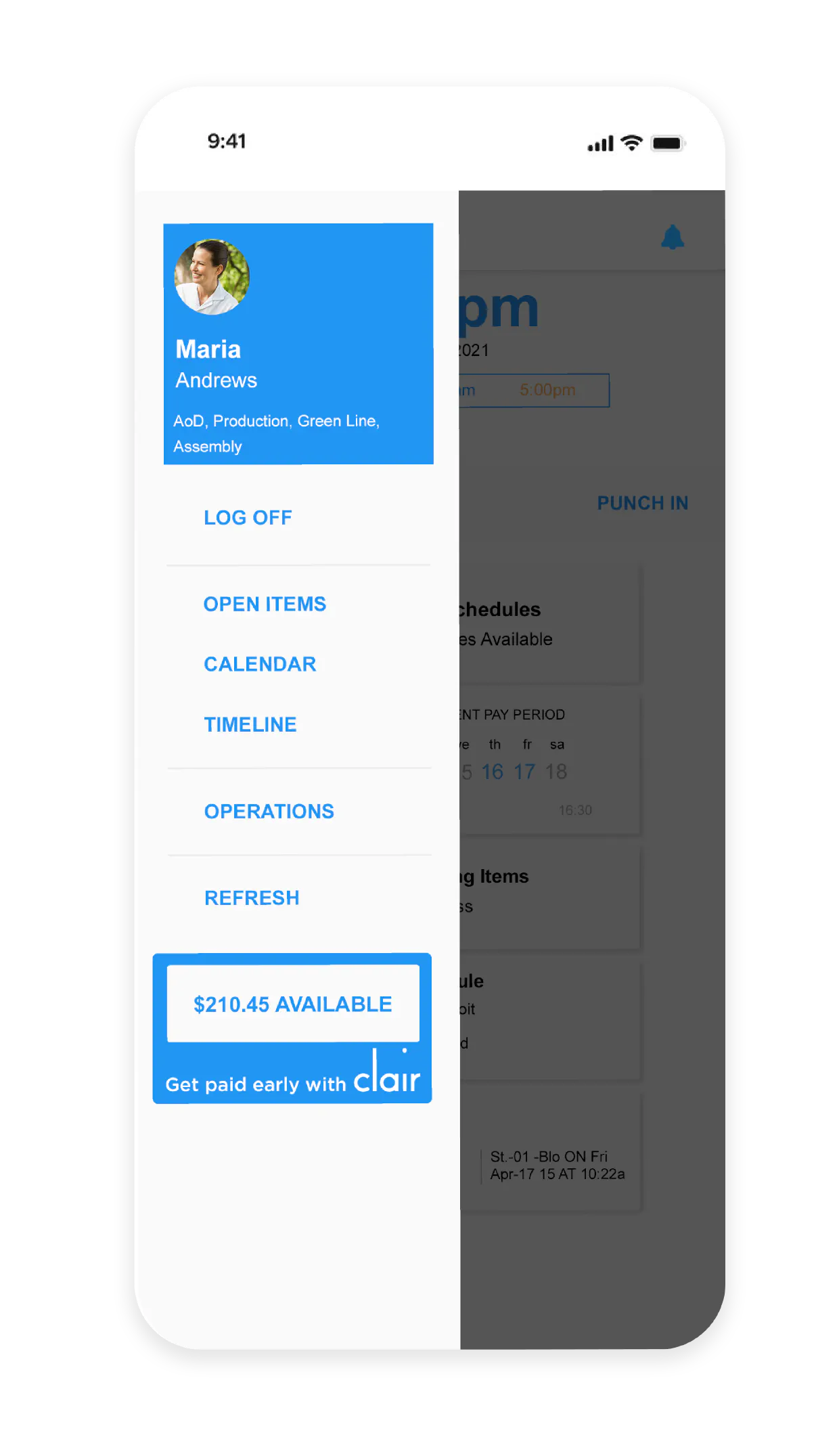

With WorkSync, it doesn’t require any changes to employer payroll; all funds are advanced and collected by Clair, a third-party provider.

How It Works

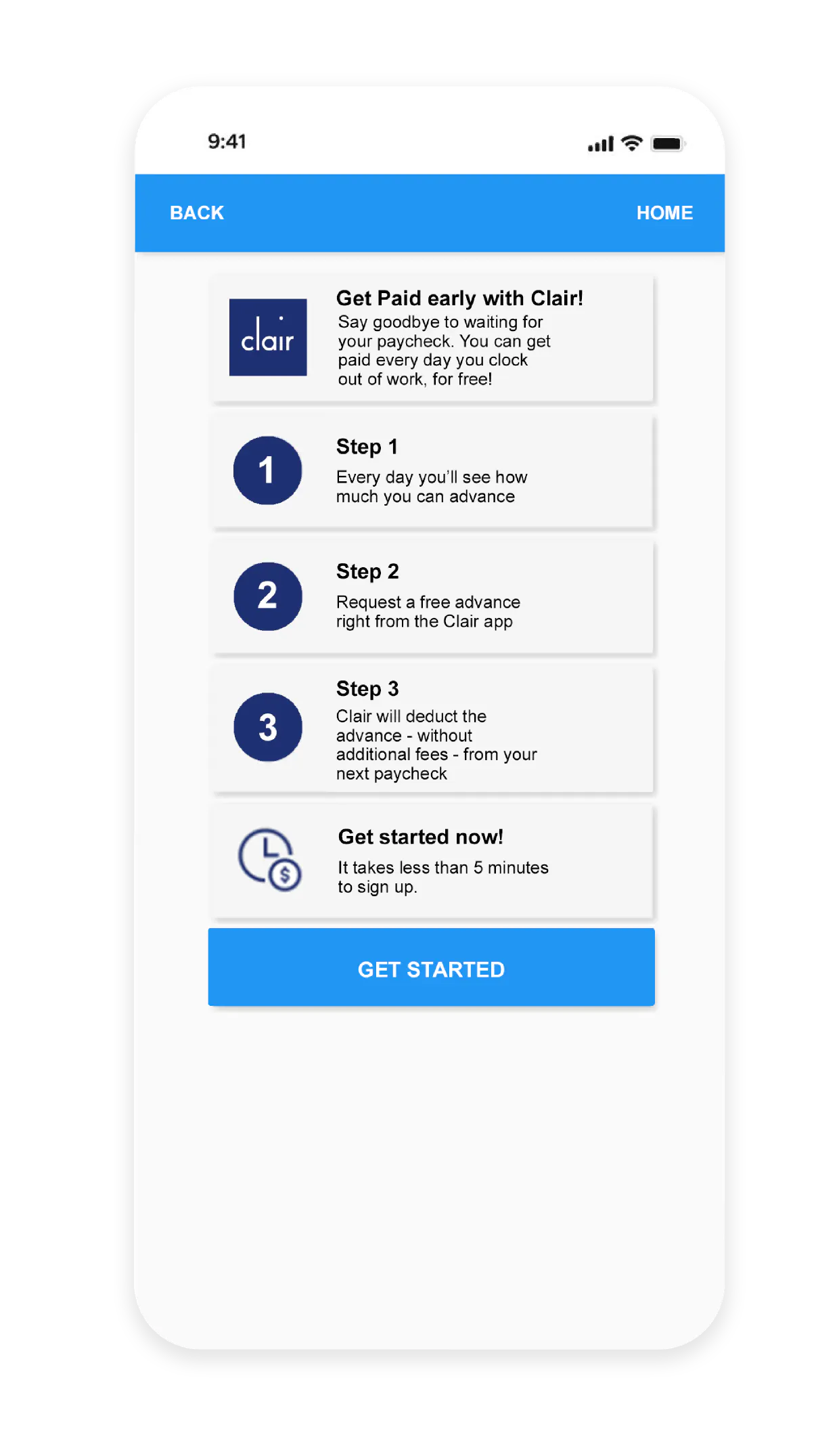

WorkSync Wallet is easy to use and fits right into your existing processes. The service is free for employers and doesn’t charge employees for wage advances.

Step 1

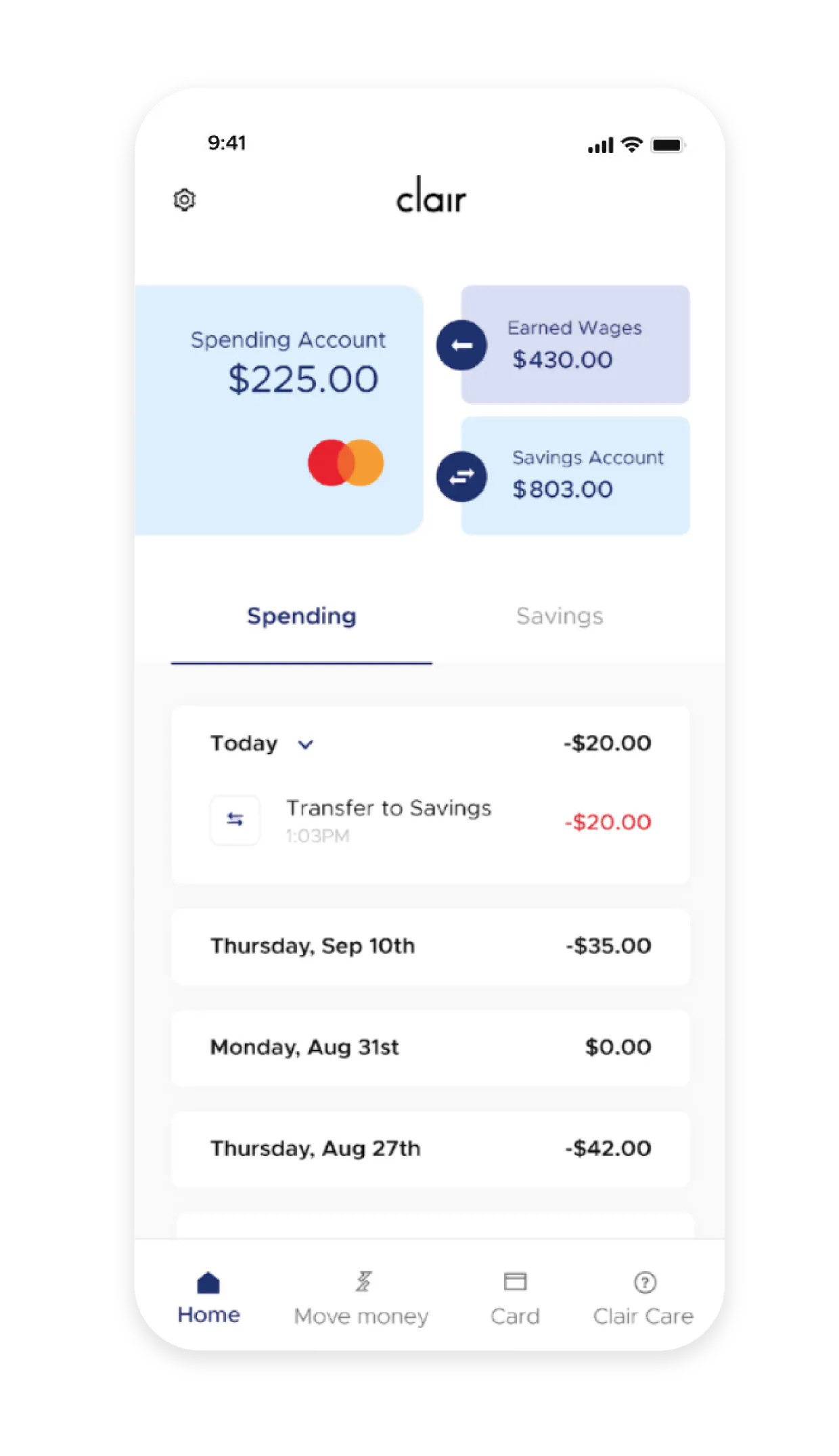

Employees simply switch their direct deposit account to Clair.

Step 2

Clair offers free wage advances to employees at the end of each shift.

Step 3

Requested advances are transferred to the Clair account and can be used immediately with a Clair Debit Mastercard®.

Step 4

Advances are deducted once employees receive their paycheck.

Benefits for Employees

Increased workforce productivity

Free wage advances provide employees with greater liquidity and improved financial health.

Ability to cover emergency expenses

Employees can pay for emergency expenses without having to borrow from predatory, high-interest payday lenders.

Fee-free digital banking

The digital bank account and debit card are a crucial help to unbanked or underbanked employees.

Benefits for Employers

Offering WorkSync Wallet helps you become an employer of choice and enjoy benefits in several key areas.

Improved financial health

- 86% of employee users improve their job performance

- 34% reduction in absenteeism among users

Reduced payroll expenses

- $4.43 per-employee-per-month savings in printing paper checks

- 100% increase in working capital by moving to biweekly payroll

Savings in hiring, training & recruitment

- 40% reduction in employee turnover

- 200% increase in job applicants

- 52% reduction in the time it takes to fill positions